kern county property tax rate

The median property tax in Hays County Texas is 3417 per year for a home worth the median value of 173300. With easy access to tax sale information and auction results you can research properties and enter bids from anywhere in the world.

Kern County Treasurer And Tax Collector

Welcome to the Kern County online tax sale auction website.

. In addition the County serves as the local government for all unincorporated areas. DeedAuction is part of our offices. Two Family - 2 Single Family Units.

Kern County is located in the US. Total tax rate Property tax. North Carolinas median income is 55928 per year so the median yearly property.

You can also search by state county and ZIP code on. Kern County Property Tax Search Kings County Property Tax Search Los Angeles County Property Tax Search Madera County Property Tax Search. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The property tax rate in the county is 078. Hays County collects on average 197 of a propertys assessed fair market value as property tax.

The countys average effective tax rate is 095. Overview of Riverside County CA Taxes. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year.

California City Documentary and Property Transfer Tax Rates Governance. Hays County has one of the highest median property taxes in the United States and is ranked 118th of the 3143 counties in order of median property taxes. The County is committed to the health and well-being of the public.

The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than North Carolina. Jails vital records property records tax collection public health and social services.

Per 1000 RevTax Code Per 1000 General Law PropertyValue Sec 11911-11929 PropertyValue or Chartered City Rate County Rate Total ALAMEDA COUNTY 110 110 ALAMEDA Chartered 1200 110 1310 ALBANY Chartered 1500 110 1610 BERKELEY Chartered 15 for up to. Two Family - 2 Single Family Units. This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property.

Violent crime rate per 1000 persons Property crimes Property crime rate per 1000 persons Arvin. Excluding Los Angeles County holidays. We are accepting in-person online and mail-in property tax payments at this time.

Riverside County taxpayers face some of the highest property tax rates in California. That is nearly double the. Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am.

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

Property Tax California H R Block

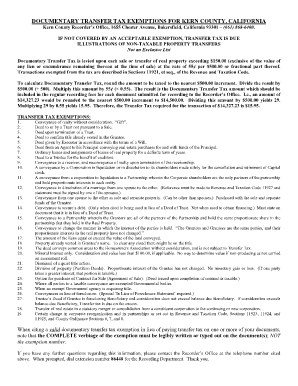

Kern County Assessor Forms Fill Online Printable Fillable Blank Pdffiller

As Kern County Goes So Goes The Nation Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

Kern County Treasurer And Tax Collector

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

Kern County Treasurer Secured Property Tax Bills Mailed Kern Valley Sun

Kern County Treasurer And Tax Collector

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

City Of Wind Quickly Developing In Kern News Bakersfield Com

S(b5dbh4fnmqkky1pyfuainxjg))/SharedFiles/img/kern-logo-cropped-stacked.png)